How Much Is The Standard Deductible In Health First Account

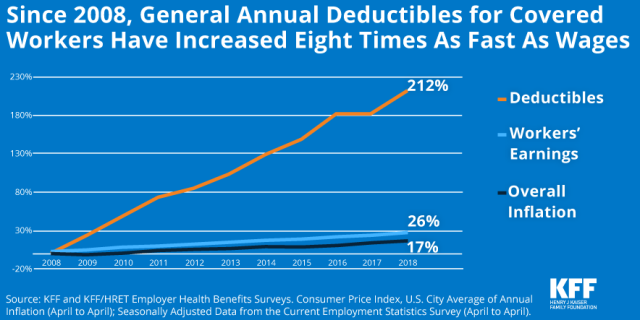

In 2018 the median annual deductible for private industry workers participating in HDHP plans was 200000. Open a Health Savings Account HSA Yes Active Employees Yes Active Employees Have a Reimbursement Account Yes Active Employees Limited Purpose Medical Reimbursement Account Annual Deductible Higher Higher How You Pay for Most Medical Care Percentage of cost after deductible You must meet the deductible 1400 for individual.

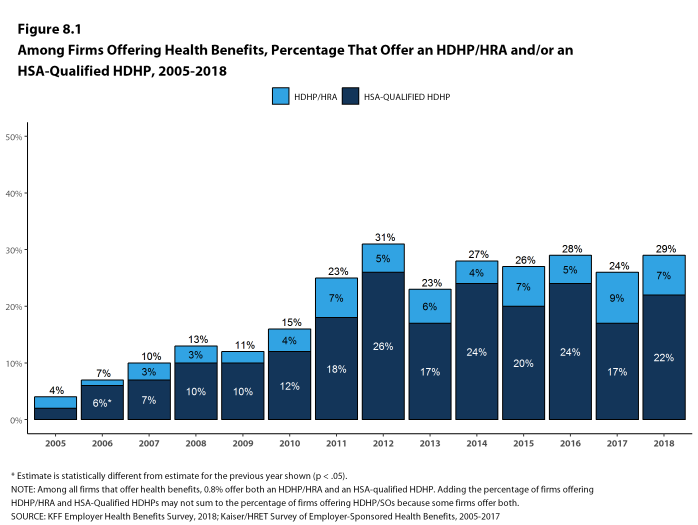

Section 8 High Deductible Health Plans With Savings Option 9240 Kff

If your deductible is 500 you need to spend 500 for covered healthcare services within one year before your plan or program will start paying for your health services.

How much is the standard deductible in health first account. Yes you can only deduct the amount that exceeds 75 of your adjusted gross income AGI for 2020. Whose medical expenses can I deduct. Most homeowners and renters insurers offer a minimum 500 or 1000 deductible.

Is there a dollar limit on claiming a medical deduction. For calendar year 2021 these amounts for HDHPs are. For 2020 the maximum contribution amounts are 3550 for individuals and 7100 for family coverage.

They may be as high as the maximum OOP costs. For the 84 percent with a deductible the median annual deductible was 50000. An HSA is an account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses as defined in the tax law.

You can deduct any medical expense for you your spouse and qualifying dependents. 35 per quarter over-the-counter OTC allowance 12 one-way trips to an approved provider location or no dental deductible rather than the 100 dental deductible standard with the plan. After age 65 you can use your health savings account for any expense youll simply pay ordinary income taxesjust like a 401k.

Not all plans require deductibles. Health insurance costs are included among expenses that are eligible for the medical expense deduction. But only an HSA lets you take tax-free distributions for qualified medical expenses.

Raising the deductible to more than 1000 can save on the cost of the policy. In order to itemize deductible expenses must be more than 75 of your adjusted gross income AGI. Minimum deductible The amount you pay for health care items and services before your plan starts to pay Maximum out-of-pocket costs The most youd have to pay if you need more health care items and services Individual HDHP.

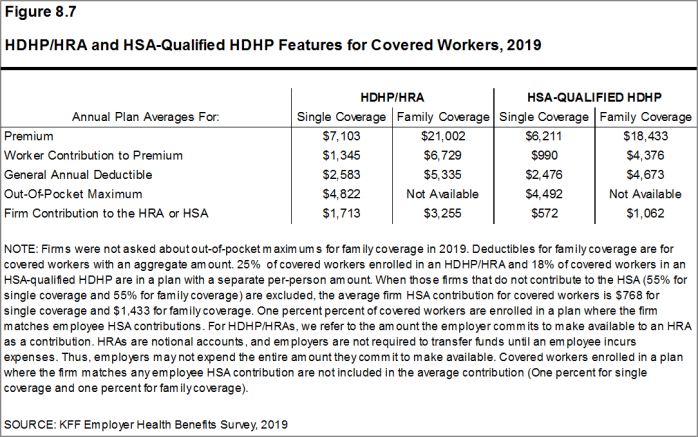

Both accounts let you make pre-tax contributions and grow tax-free earnings. The deductibles for an HDHP are often higher than the minimums of 1400 single and 2800 family. You must itemize to claim this deduction and its limited to the total amount of your overall costs that exceed 75 of your adjusted gross income AGI.

This plan is designed. We assume that after this threshold has been reached that your insurance covers 100 of your expenses. In 2021 for a HDHP the minimum deductible amount is 1400 for self-only coverage and 2800 for family coverage.

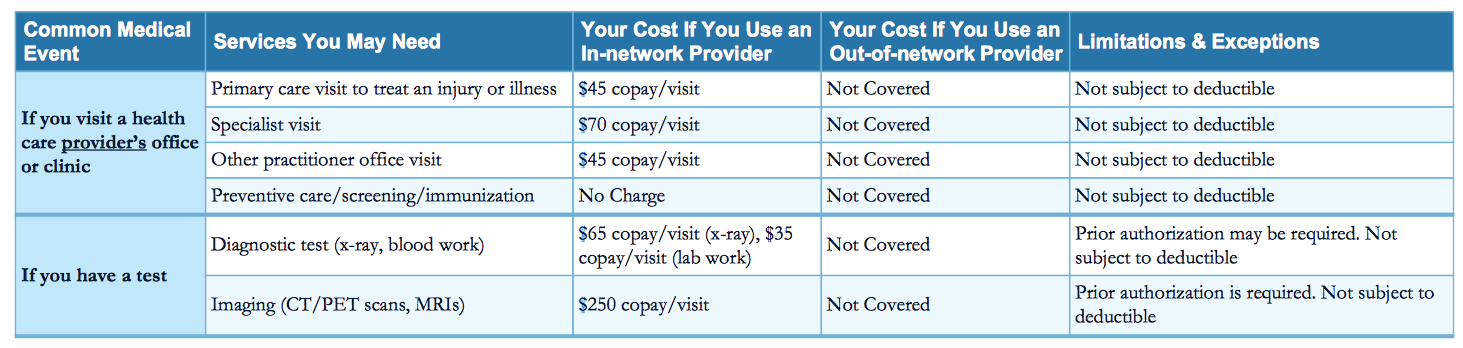

And you dont need referrals to see in-network specialists. Going to a 1000 deductible may save you even more. High-Deductible Health Plans Defined.

In addition you may choose one Choice Extras benefit upon enrollment. According to IRS rules an HDHP is a health insurance plan with a deductible of at least 1400 if you have an individual planor a deductible. You can only open and contribute to a HSA if you have a qualifying high-deductible health plan.

This is separate from a monthly premium payment. For example to protect yourself against the first 10000 of medical expenses you could put 10000 in a dedicated account such as a Health Savings Account. Of course remember that in the event of loss youll be responsible for the deductible so make sure that youre comfortable with the amount.

7000 for a single person and 14000 for a family in 2021. Dont leave money on the table File your taxes claim your medical expenses and get every credit and deduction you deserve. By using pre-tax dollars in an HSA to pay for deductibles copayments coinsurance and other qualified expenses including some dental drug and vision expenses you can lower your overall health care costs.

Maximum OOP costs include deductibles co-payments and coinsurance. For private industry workers participating in non-HDHP plans 16 percent did not have a deductible. An HSA contribution deduction lowers your AGI which could make it easier for you to pass the 75 hurdle.

See IRS Publication 502 PDF for more information. Annual deductible that you are required to pay before your health insurance begins coverage.

High Deductible Health Plan Hdhp Pros And Cons

Two Years Without Health Insurance And What I M Doing Now Mr Money Mustache In 2021 Personalized Medicine Health Primary Care

Is There A Medicare Deductible Medicare Faqs

Section 8 High Deductible Health Plans With Savings Option 9240 Kff

Understanding Key Health Insurance Terms Advice Blog

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30 Co Insurance Health Insurance Health Insurance Cost

7 Tax Deductions You Shouldn T Miss Small Business Tax Deductions Tax Deductions Business Tax Deductions

Are Health Insurance Premiums Tax Deductible Insurance Deductible Health Insurance Best Health Insurance

How A Health Savings Account Leads To Health And Wealth Health Savings Account Savings Account High Deductible Health Plan

Section 8 High Deductible Health Plans With Savings Option 9335 Kff

Guide To Mental Health Co Payments Co Insurance And Deductibles

How The Obamacare Metal Tiers Affect You Healthcare Costs Health How To Plan

2021 Medicare Costs Premiums Deductibles Irmaa Medicare Financial Information Higher Income

How Much Is My Doctor S Visit Going To Cost

Section 8 High Deductible Health Plans With Savings Option 9335 Kff

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Posting Komentar untuk "How Much Is The Standard Deductible In Health First Account"